Problem statement (need assessment of banks and financial institutions)

Safekeeping and protecting precious personal objects and documents have always been one of the concerns of people. The safe deposit box is one of the banking services for preserving documents, property, and precious objects, and equipping it with safety and protection systems has made it possible for clients to rent these safes and keep any document and valuable object in this place with peace of mind. Using banks and financial institutions' safe deposit boxes is a safe way to store valuable assets that cannot be kept at home, and natural or legal persons may use these rental safes for as long as they like.

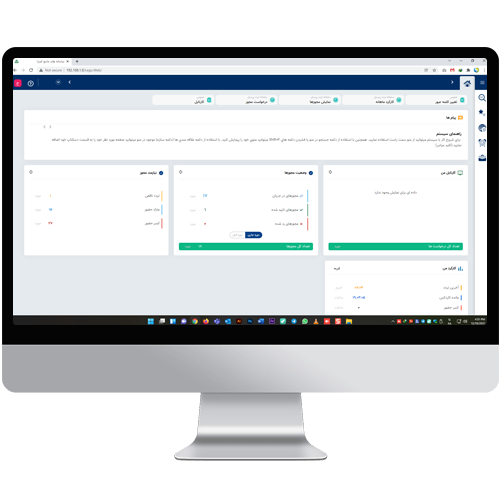

One of the problems that banks and financial institutions face is the access of clients or their approved representatives to the contents of safe deposit boxes. Also, the biggest concern of banks and financial institutions is to authenticate and identify the client and more importantly his approved and introduced representative to access safe deposit boxes. The smallest error in their authentication can cause irreparable damage to the centers.

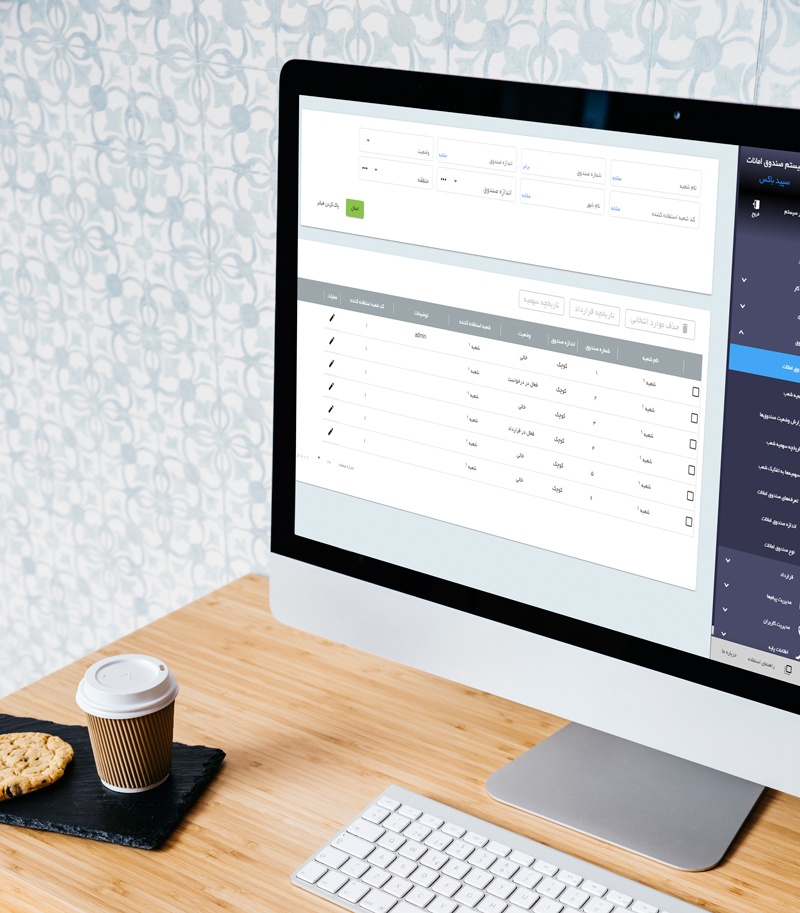

Many bank branches do not offer safe deposit boxes. On the other hand, many bank clients need to rent a safe deposit box. Therefore statistics of all full and empty safe boxes, details of contracts concluded with clients, branch status across the country, and reporting should be managed centralized so that boxes can be allocated to all applicants optimally.