Introducing SepidBox safe deposit box software

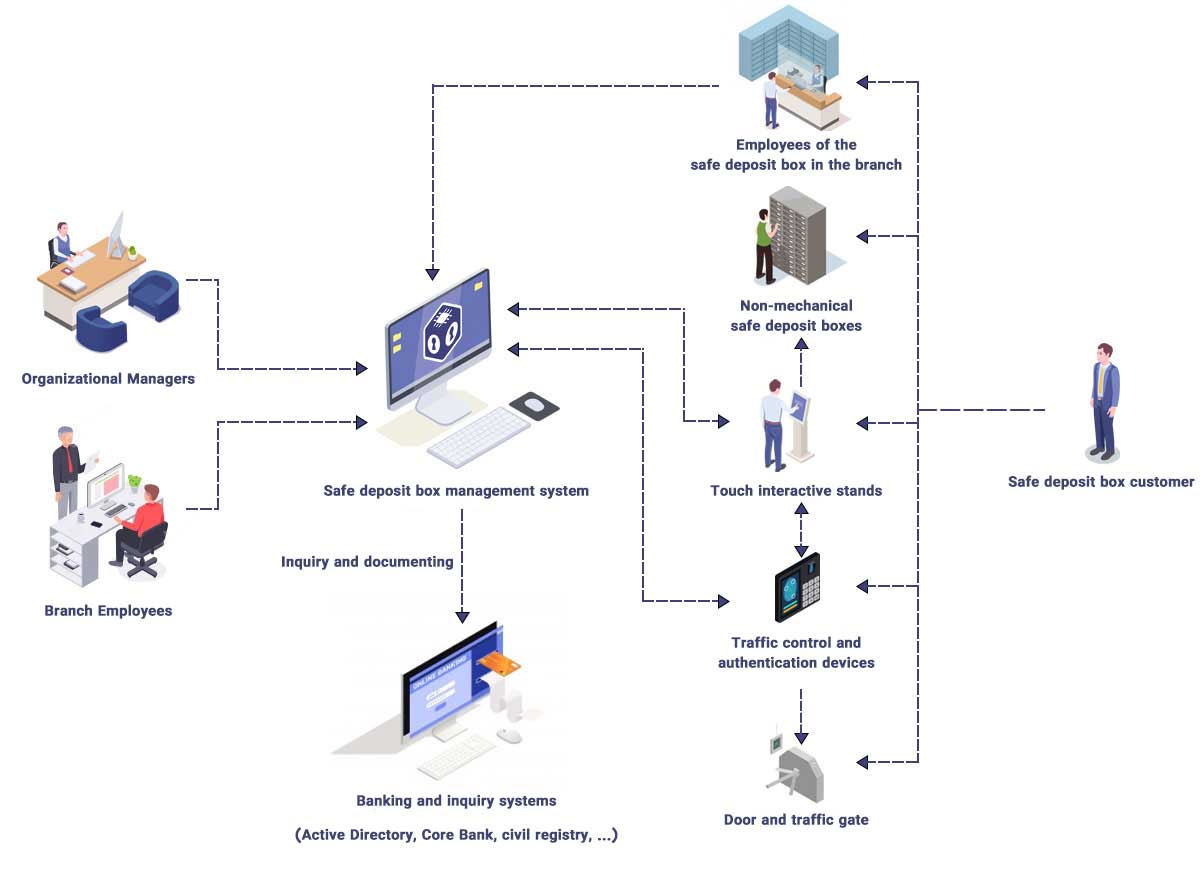

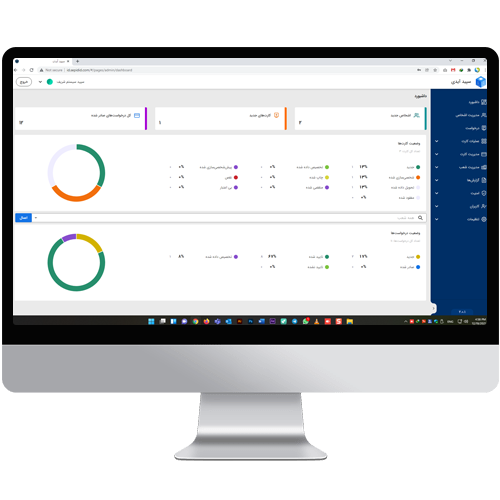

The SepidBox safe deposit box software is an integrated system for safe deposit box management that allows banks and financial institutions to define the box, assign the box to different branches, manage bank clients (partners or their lawyers), manage contracts, control access, permit access and provide various reports.

This system is web-based, so banks and financial institutions can give proportional access to all branches across the country (or the world) and manage all bank safes in a central and integrated manner.

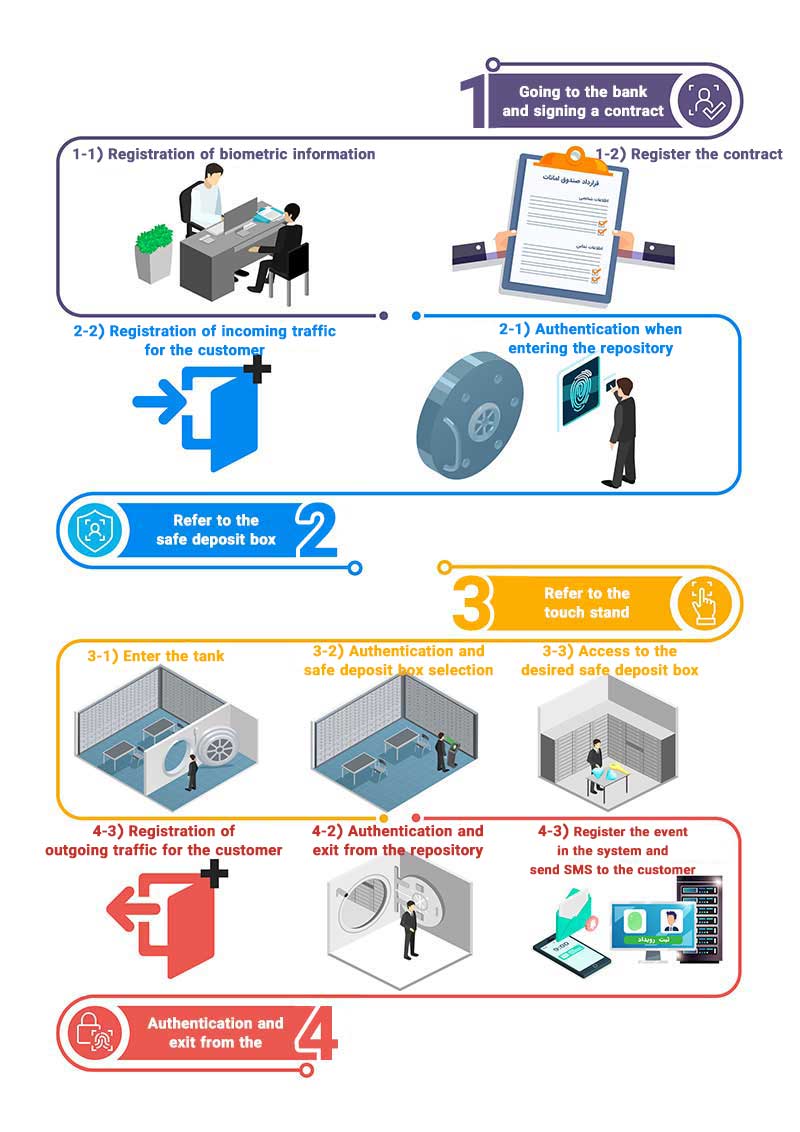

The SepidBox can connect to authentication hardware such as fingerprint and face recognition systems and identify based on them and manage these hardware. In this way, with the help of the SepidBox, a comprehensive and integrated software and hardware solution can be implemented to manage safe deposit boxes in the bank.

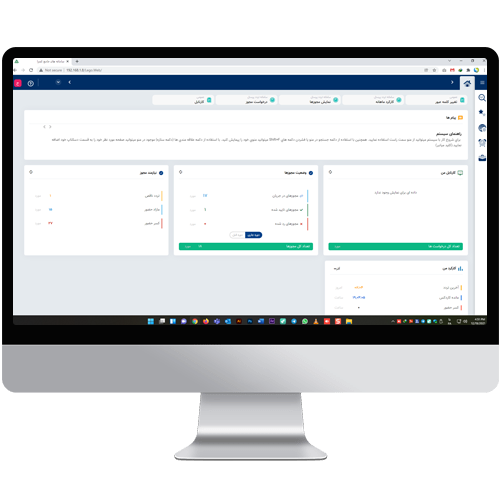

The SepidBox safe deposit box software is a safe deposit box management and automation system that provides a comprehensive solution for maintaining security and discipline to the management of banks, financial institutions, and other centers and organizations by connecting to access control hardware equipment and communicating with all types of safes.

The SepidBox safe deposit box management software connects with identity verification hardware such as fingerprint and face recognition systems to ensure the authentication of the clients or legal lawyers of the box owners and the accurate registration of accesses.

Due to the high importance of authentication and validation when clients access the safe deposit box of the bank and to make sure of the identity confirmation and identification of the owner of the safe deposit box or his legal representative, the automation system of the safe deposit box must be designed very safe and accurate and all accesses or access requests of authorized and unauthorized persons be recorded and archived so that they can be reported if necessary.