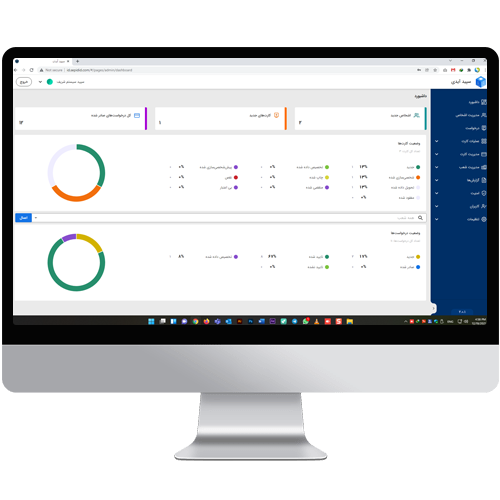

Problem statement (need assessment) of remote (digital) authentication

Nowadays, with the increasing development of cyberspace and people's use of online services, the general tendency to not visit in person and do things remotely is increasing every day. This issue is obvious in receiving financial and banking services, stock exchange and insurance, civil registration and mobile operators. Solutions that enable the organization to verify the client's identity online and without the need for physical presence (online authentication) are called "virtual authentication", "internet authentication" or "online authentication".

What is remote authentication (digital authentication)?

For example, a major part of the banks activity that was done by the bank in the past, is done by the clients themselves in the new generations of banking. But despite clients' access to most banking services, one of the challenges in this field is still the identification and validation of clients' identity (KYC). In the traditional approach, this issue is solved by clients visiting the branches in person, while remote and electronic authentication (e-KYC) or simply internet authentication can be used for this purpose. Despite the existence of some e-KYC solutions in the world, especially in virtual banks and leading banks, this issue is still not resolved, especially for new clients, and forces the client to attend one of the branches. In addition to new clients, access to some sensitive banking services, such as transferring large amounts of money, also requires secure authentication for existing clients.

Why remote authentication?

The requirement to visit the branches in person leads to client dissatisfaction on the one hand and increasing bank costs on the other hand. Therefore, remote authentication is one of the vital requirements for banks and one of the attractive services for clients. On the other hand, remote authentication brings the bank's concern about increasing security risks and non-compliance with related laws (especially anti-money laundering and terrorist financing laws), which should be taken into account.

Digital authentication service (remote authentication) is one of the requirements of generation 4.0 banking and the development of Omni-Channel in banking services, and it becomes more important in special situations such as the Corona crisis, when non-presence of people in public places such as bank branches is necessary. Currently, e-KYC service is provided by various companies in the world for a large number of businesses (including banks and insurances), such as YOTI and IdentityMind.